Understanding compound interest

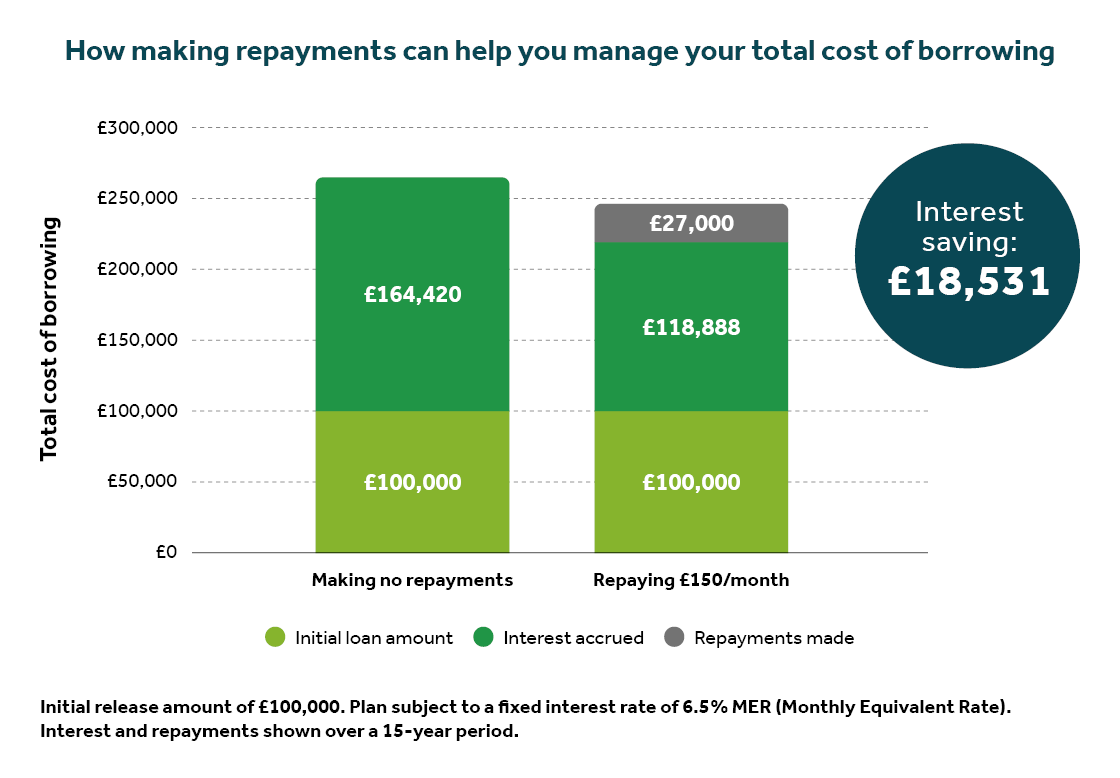

Unless you have a Payment Term or Interest Reward lifetime mortgage, or you wish to make voluntary payments to better manage your cost of borrowing, there are typically no repayments to make with a lifetime mortgage until the plan comes to end.That's because the loan, plus roll-up interest, is usually repaid through the sale of the property when the last remaining applicant passes away or moves into long term-care. As a result, a lifetime mortgage is subject to compound interest.

This means interest is first charged on the amount you borrow. After that, each month (or year, depending on your plan), the interest is added to your loan balance, including any previous interest. This means you start paying interest on interest, causing the total amount you owe to grow over time. This continues until the loan is repaid, so the balance can increase quickly.