Many customers are, of course, looking to use equity release to help remove the burden of increasing monthly mortgage costs, or the repayments required on unsecured debt, such as credit cards.

However, even repaying £100 a month towards an equity release plan can go a long way to improving a customer’s outcome in the medium to long-term, and a detailed discussion on the benefits of this approach with clients is essential.

Other articles

-

Flat roofs helpsheet

Flat roofs greater than 25% are now the most common reason for case declines at more2life, so we take a closer look at flat roofs - the main issues, what lenders take into consideration and more

Download -

Proximity to commercial helpsheet

Proximity to commercial properties remains a common reason for case declines - so we take a look at some of the influencing factors which can be taken into consideration by lenders

Download -

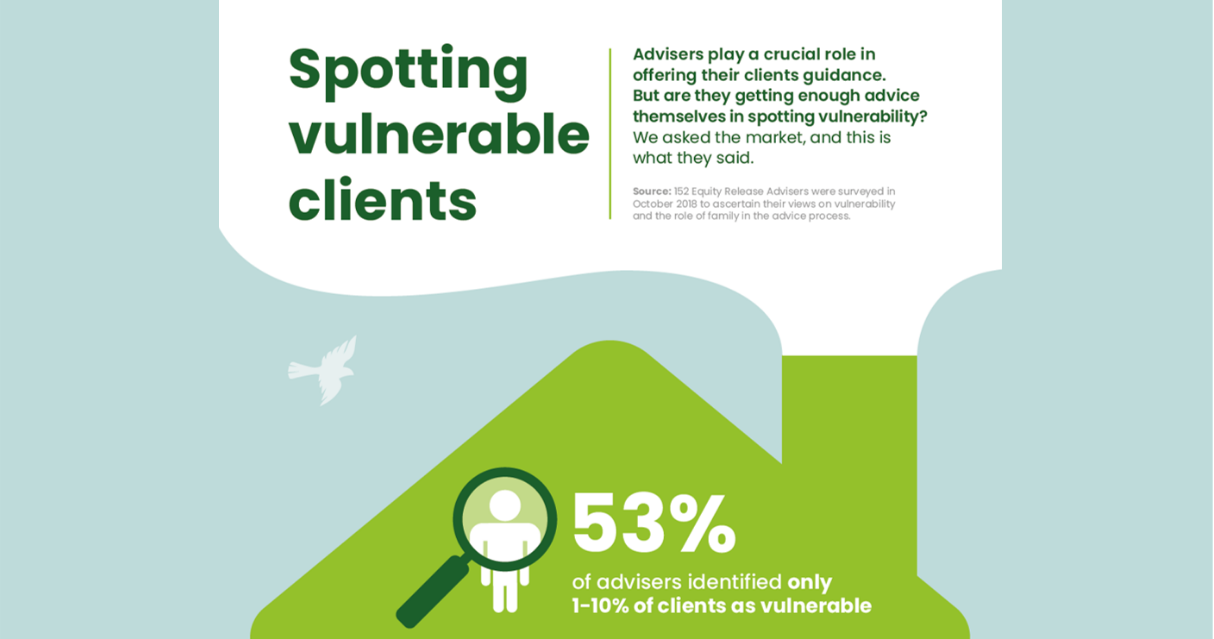

Useful stats about vulnerable clients

We did some research with advisers about your thoughts on vulnerable clients, and this is what you said...

Download -

Clutter helpsheet

As severe clutter climbed the list of the most common reasons for declined cases at more2life, from 6th to 3rd between 2019 and 2020, we take a look at why severe clutter is an issue for underwriting lifetime mortgages.

Download