We use essential cookies to make our website work properly when you visit us. We’d also like your consent to set other non-essential cookies to help us improve our website and tailor the marketing you see.

What is Tailored Interest Reward?

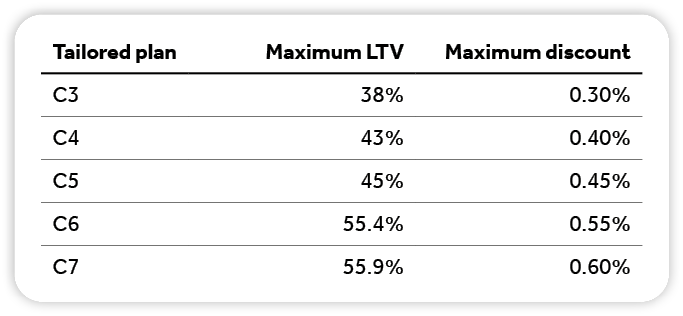

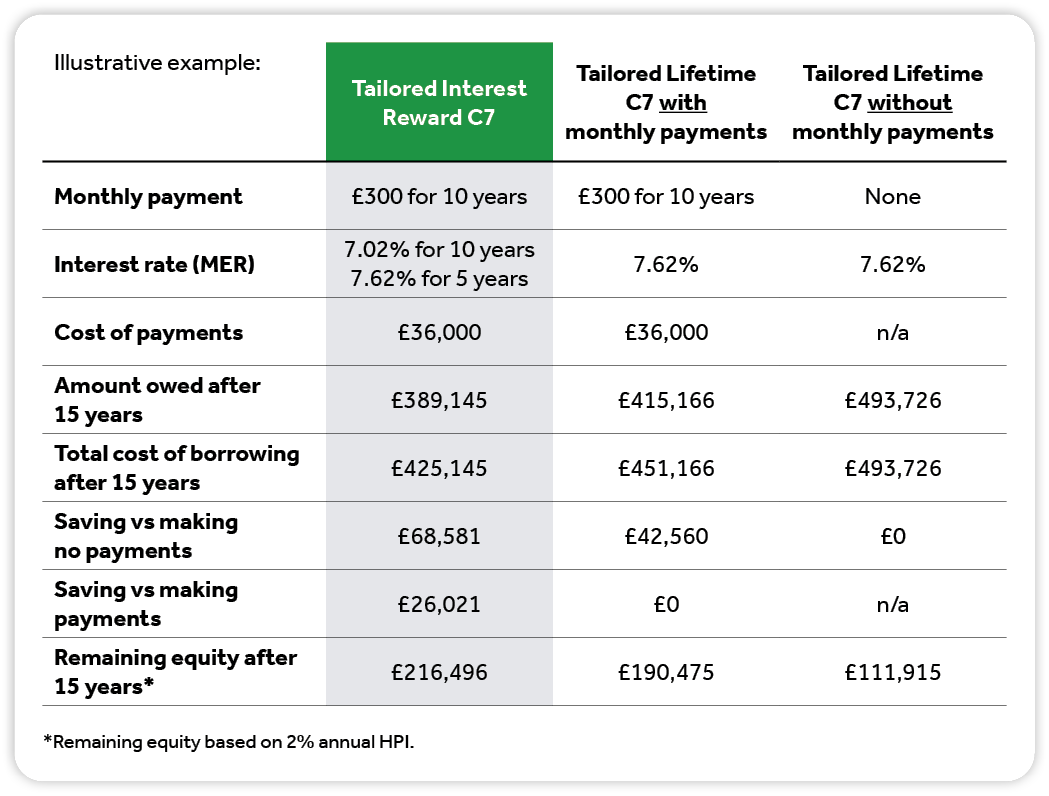

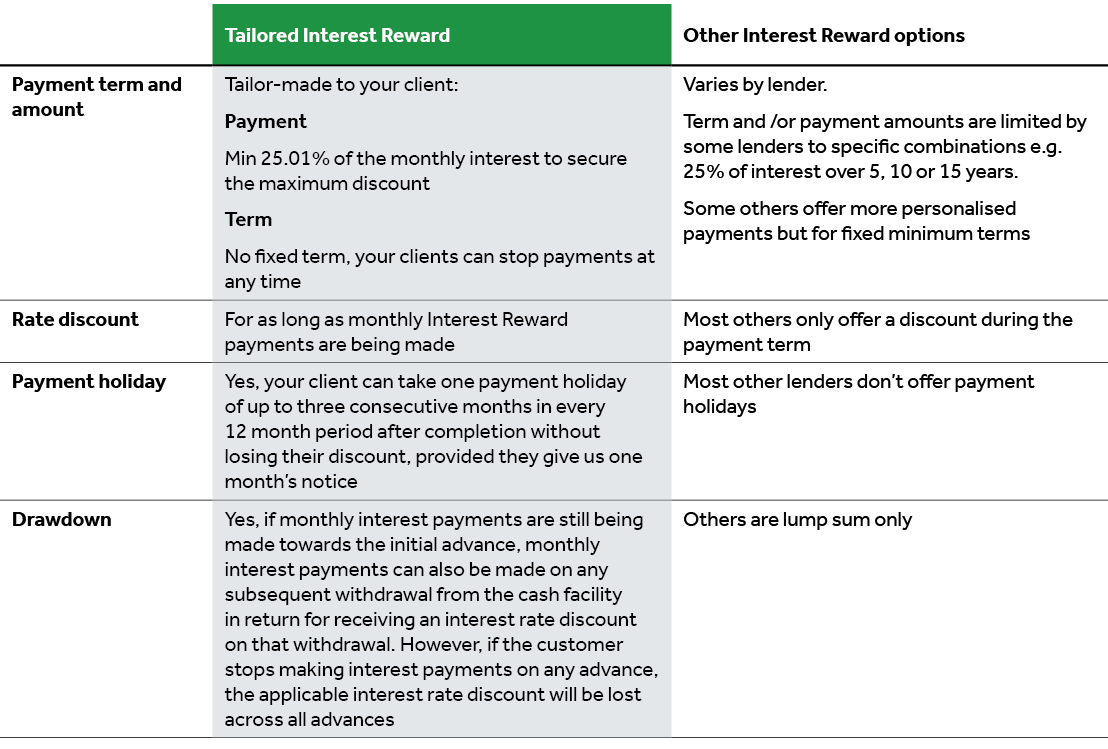

Tailored Interest Reward is an innovative lifetime mortgage designed to give your clients more control over their borrowing costs.Whether lump sum or drawdown, it allows customers to tailor their monthly payment to their circumstances; with interest rate discounts up to 0.60%, no fixed term and only a part-interest payment required to secure the maximum discount.

Adviser Guide

Create KFI

.png?ext=.png)