We use essential cookies to make our website work properly when you visit us. We’d also like your consent to set other non-essential cookies to help us improve our website and tailor the marketing you see.

What is Flexi Interest Reward?

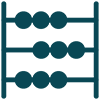

Flexi Interest Reward is a feature of our Flexi lifetime mortgage where your client is rewarded with an interest rate discount for making a period of monthly payments.It allows your customers to choose their own monthly payment and payment term.* In return, they’re rewarded with a personalised interest rate discount for life, providing all payments are made.

Adviser Guide

Create KFI

*Subject to criteria

.png?ext=.png)

.png?ext=.png)