We use essential cookies to make our website work properly when you visit us. We’d also like your consent to set other non-essential cookies to help us improve our website and tailor the marketing you see.

Go back

.png?ext=.png)

Higher LTV & lower rate : How Tailored Enhanced can deliver better customer outcomes

In a post-Consumer Duty world, asking the right questions has never been more crucial. That goes beyond straightforward appointments and sourcing sessions. To ensure you deliver the best customer outcome, your advice must be detailed and personalised.

Following the return of more2life’s medically enhanced product; Tailored Enhanced, earlier this year, exploring a customer’s medical history and lifestyle is as important as any other factor, as it can make a significant difference - just as it did for Mr Johnson.

Real-life Tailored Enhanced case study

Albert Johnson is a 65-year-old IT consultant from Manchester. On the face of it, he’s a healthy gentleman looking to address his financial concerns before retirement.

However, despite Mr Johnson insisting he’s well for his age, by using more2life’s simple 13-question health and lifestyle questionnaire, his adviser was able to discover that Albert had a few years ago suffered a stroke, has diabetes, and takes regular blood pressure medication.

By incorporating more2life’s health and lifestyle questionnaire into their advice process, and asking the right questions, Mr Johnson’s adviser was able to deliver a better customer outcome.

The better customer outcome

As a result of inputting his medical information when sourcing, Albert’s adviser could secure the 65-year-old an additional 5.45% LTV compared to the highest non-enhanced LTV product on the market. That equated to an extra £24,525.

Also, by recommending Tailored Enhanced, Mr Johnson obtained a lower interest rate - 0.29% MER lower than the highest LTV product on the market.

Tailored Enhanced product features

With a reduction in the number of enhanced products on the market during the fallout of the infamous mini-budget in late 2022, it may have become second nature not to delve too deep into your client’s medical and lifestyle background.

But by choosing not to input your customer’s medical information when sourcing, can you really be confident you’re providing the best customer outcome?

At more2life, we understand it can sometimes be difficult to extract the information you need - especially as, in most financial instances, ill health or a lower life expectancy can reduce a client’s available options.

That’s why we’ve created a free 13-question worksheet to use during your appointments to help you ask the right questions.

Download Questionnaire Now

See the higher LTVs for yourself

Still unsure whether asking health and lifestyle questions is worth it? See how more2life’s enhanced LTVs could help you deliver a better customer outcome with our Tailored Enhanced LTV Calculator.

Calculate Now

This article is intended for intermediaries only and has not been approved for customer use.

Read now

.png?ext=.png)

In a post-Consumer Duty world, asking the right questions has never been more crucial. That goes beyond straightforward appointments and sourcing sessions. To ensure you deliver the best customer outcome, your advice must be detailed and personalised.

Following the return of more2life’s medically enhanced product; Tailored Enhanced, earlier this year, exploring a customer’s medical history and lifestyle is as important as any other factor, as it can make a significant difference - just as it did for Mr Johnson.

Real-life Tailored Enhanced case study

Albert Johnson is a 65-year-old IT consultant from Manchester. On the face of it, he’s a healthy gentleman looking to address his financial concerns before retirement.

However, despite Mr Johnson insisting he’s well for his age, by using more2life’s simple 13-question health and lifestyle questionnaire, his adviser was able to discover that Albert had a few years ago suffered a stroke, has diabetes, and takes regular blood pressure medication.

By incorporating more2life’s health and lifestyle questionnaire into their advice process, and asking the right questions, Mr Johnson’s adviser was able to deliver a better customer outcome.

The better customer outcome

| Highest LTV product in the market | Tailored Enhanced | |

| Age | 65 | |

| House Value | £450,000 | |

| Medical Conditions | Diabetes, stroke, high blood pressure | |

| Max LTV | 36.55% | 42% |

| Max Release | £164,475 | £189,000 |

| Interest Rate | 8.82% MER | 8.53% MER |

As a result of inputting his medical information when sourcing, Albert’s adviser could secure the 65-year-old an additional 5.45% LTV compared to the highest non-enhanced LTV product on the market. That equated to an extra £24,525.

Also, by recommending Tailored Enhanced, Mr Johnson obtained a lower interest rate - 0.29% MER lower than the highest LTV product on the market.

Tailored Enhanced product features

- Medical and lifestyle underwriting

- Access up to 54% LTV

- Fixed ERCs

- Partial repayments available from day one (£50 min, max 10% per year)

- ERC exemption on repayment within three years of death/LTC of a partner

- Available to customers aged 55-85

With a reduction in the number of enhanced products on the market during the fallout of the infamous mini-budget in late 2022, it may have become second nature not to delve too deep into your client’s medical and lifestyle background.

But by choosing not to input your customer’s medical information when sourcing, can you really be confident you’re providing the best customer outcome?

At more2life, we understand it can sometimes be difficult to extract the information you need - especially as, in most financial instances, ill health or a lower life expectancy can reduce a client’s available options.

That’s why we’ve created a free 13-question worksheet to use during your appointments to help you ask the right questions.

Download Questionnaire Now

See the higher LTVs for yourself

Still unsure whether asking health and lifestyle questions is worth it? See how more2life’s enhanced LTVs could help you deliver a better customer outcome with our Tailored Enhanced LTV Calculator.

Calculate Now

This article is intended for intermediaries only and has not been approved for customer use.

Other articles

-

The adviser

Not everything is as it seems with this client...

Watch now -

Proximity to commercial helpsheet

Proximity to commercial properties remains a common reason for case declines - so we take a look at some of the influencing factors which can be taken into consideration by lenders

Download -

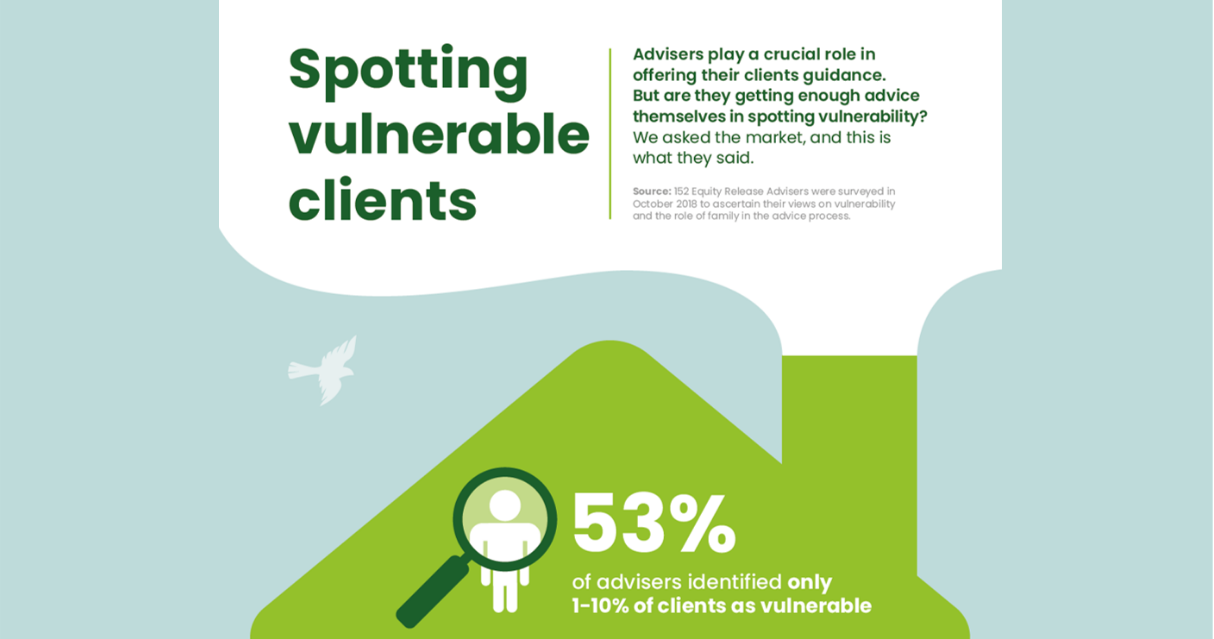

Useful stats about vulnerable clients

We did some research with advisers about your thoughts on vulnerable clients, and this is what you said...

Download -

How a Flexi lifetime mortgage could have helped Jon & Sarah pay off mounting debt

Unlike most products in the market, Flexi Choice allows borrowers to move up or down the LTV curve, adjusting with their needs. Read how it could have helped Jon & Sarah pay off their mounting debt.

Read now