We use essential cookies to make our website work properly when you visit us. We’d also like your consent to set other non-essential cookies to help us improve our website and tailor the marketing you see.

What is Apex Interest Reward?

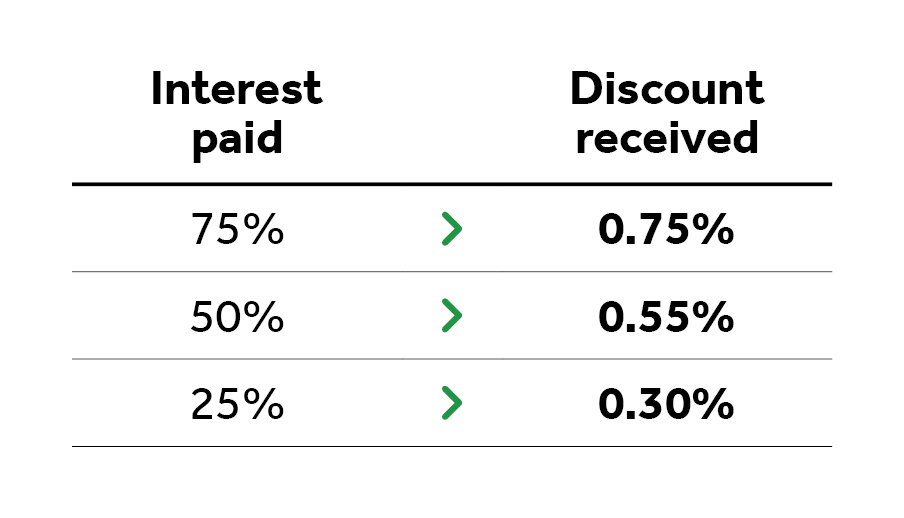

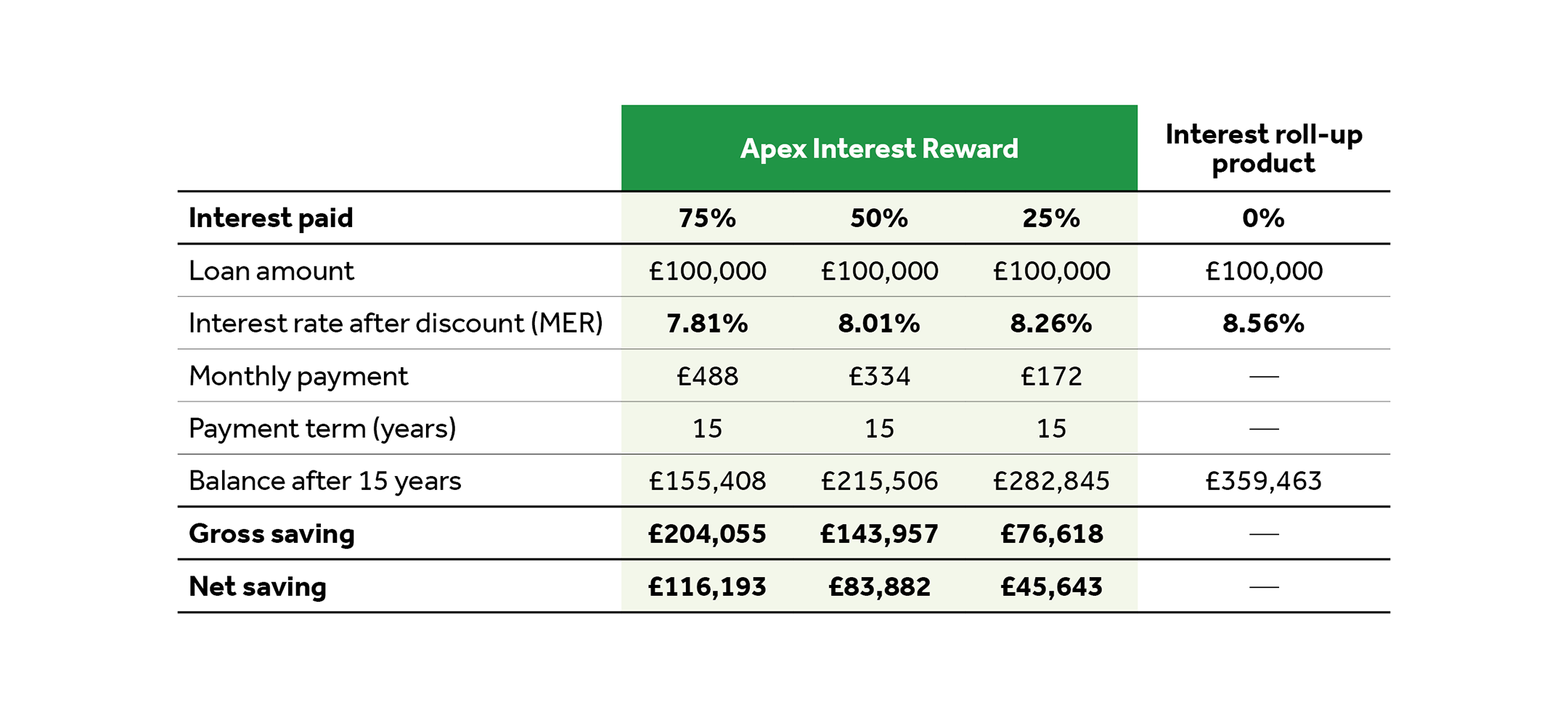

Apex Interest Reward is a feature of our Apex lifetime mortgage that could help your client save thousands over the life of their plan.By committing to making payments for 15 years, your client will be rewarded with an interest rate discount of up to 0.75% for the same period.

Adviser Guide

Create KFI

.png?ext=.png)

.png?ext=.png)